|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Oregon Refinance Interest Rates: A Comprehensive GuideIntroduction to Refinance Interest RatesWhen considering refinancing your home in Oregon, understanding refinance interest rates is crucial. These rates determine your monthly payments and the overall cost of your loan. Let's delve into the factors affecting these rates and why they are important. Factors Influencing Refinance Interest RatesCredit ScoreYour credit score is one of the most significant factors. A higher score typically means lower rates. Improving your credit score can save you thousands over the life of your loan. Loan-to-Value Ratio (LTV)The LTV ratio is the amount of your loan compared to the appraised value of your home. Lower LTV ratios often result in more favorable rates. Market ConditionsInterest rates are also influenced by broader economic factors such as inflation and the Federal Reserve's policies. Staying informed about these can help you time your refinancing effectively. Benefits of Refinancing in Oregon

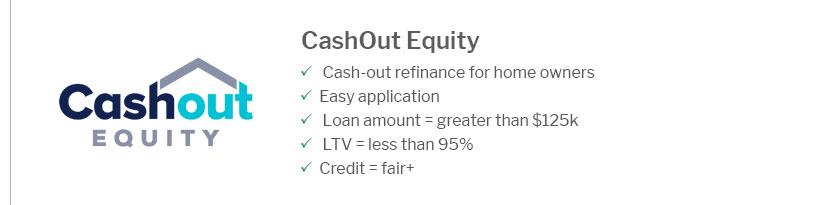

For more personalized advice, consider consulting with some of the best rated home refinance companies in Oregon. Steps to Secure the Best Refinance Rate

Frequently Asked QuestionsWhat is a good interest rate for refinancing in Oregon?A good interest rate varies based on economic conditions and personal financial factors. Generally, anything below 3% is considered competitive in a low-rate environment. How often can you refinance your home in Oregon?There are no set rules on how often you can refinance, but it's important to consider closing costs and whether the financial benefits outweigh these costs. Does refinancing affect your credit score?Yes, applying for refinancing can temporarily lower your credit score due to the hard inquiry, but the impact is usually minimal. https://www.moneygeek.com/mortgage/rates/oregon/refinance/

Oregon's current mortgage refinance rates are 5.94% for a 15-year fixed loan and 6.37% for a 30-year fixed loan, lower than the national ... https://www.usbank.com/home-loans/mortgage/mortgage-rates/oregon.html

Compare Oregon mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. https://www.onpointcu.com/home-loans/home-refinancing/

7077 or 800.527.3932 (M-F 7 a.m. to 7 p.m., Sat. 9 a.m. to 3 p.m.) Get started with your mortgage loan new purchase or refinance. Check rates, calculate your ...

|

|---|